Understanding Your Share Market

The NZ share market is very small but with extraordinarily bright spots. The brightest of these are our utilities: Ports, airports, energy producers, which are well managed and listed on the stock market making for excellent dividend paying investments. The dividends attract little taxation because of imputation credits.

The reason for this strong investment sector has its roots in the 1980s, when a change of government and a new finance minister, Roger Douglas, decided to break open the heavily regulated economy that had existed and in the process privatised its major state owned assets, listing them all on the stock market in a state private investor partnership.

That means stuffy, often badly managed monopolies were now required to insert top managers who could produce returns on capital that the share investors demanded.

Auckland Airport, Ports of Auckland, Port of Tauranga, Air New Zealand, Telecom, Contact Energy and many others - almost everything it owned was privatised and listed on the share market.

Decades later this sector now exists to provide a core of safe, cash generating semi-monopolies that serve the centre of your New Zealand share portfolio.

The returns from these companies come to you largely in the form of cash dividends, with moderate capital gains over the years. The compounding affect ensures that the returns from these have been anything but sedate.

Not only the utilities pay high dividends, but in general the NZX companies return a very high proportion of cash to investors, amounting to 85% of earnings per year that are paid to shareholders, compared to 55% for the US companies, but matched by Australia.

This gives the NZX a high yield of 4%, compared to 2% in the US and 4% in Australia.

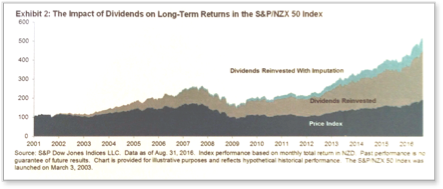

Below is a graph showing the impact of our high dividend paying regime. It is evident that the reinvested returns from your cash dividend (light grey area) accounts for a bigger proportion of returns than the gain in share prices (dark grey area). The lighter area at the top is the returns from receiving tax free dividends (the imputation benefit).

NZ Sharemarket: The returns come from high dividends and low taxes

This article does not constitute advice but is presented for debate. Any advice provided in relation to financial products is general in nature and is not personalised. This type of service is defined in the Financial Advisers Act 2008 as a 'class service'. It does not take into account a client's personal financial position, their goals or objectives or their risk preferences, and so should not be followed without consulting a Financial Advisor. A disclosure document for Neville Glaser can be obtained if requested at neville@glaserindicators.co.nz